onSynthetics (legacy)

onSynthetics Product Description (legacy):

With the recent emergence of the algorithmic stable coin space, the OnX platform is introducing the first ever synthetic assets platform for collateralized tokens to help the DeFi ecosystem. Starting with aETH (ankrETH) as the fractional reserve for the algorithmic Ethereum, this new synthetic assets platform will help unleash more potential in DeFi while creating new ways to manage wealth and even help enable future cross chain and layer-two solutions.

By providing an asset stabilized to the value of Ethereum, DeFi users can safely allocate funds that will always match the ever rising value of Eth. There will also be a growing ecosystem that encourages users to participate in the health, equilibrium, and collateralization of the asset through a unique and innovative multi-token synthetics arbitrage hub.

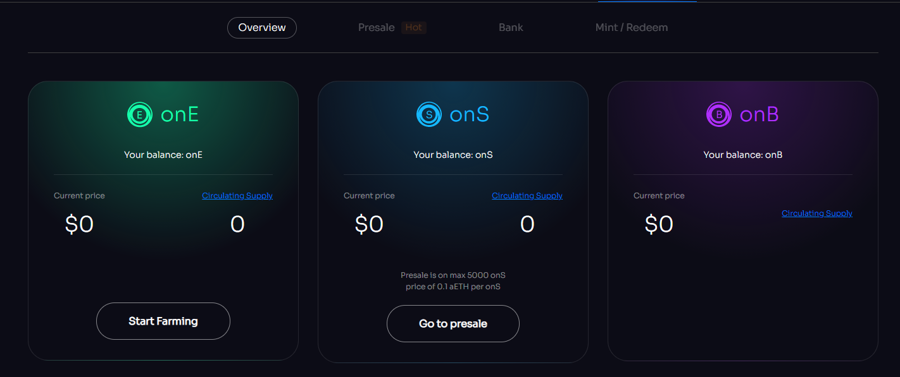

The platform will have 3 tokens:

onE — onEthereum. The onE will constantly be pegged to 1 ETH, representing synthetic Ethereum. onE will be the first and only synthetic Ethereum asset partially backed by aETH (staked Ethereum certificate), and partially backed algorithmically.

onS — onShares. The governance certificate on the OnX synthetic assets platform. onS holders will also receive benefits from the system in the form of seigniorage, and interest from aETH.

onB — onBonds. The bond certificate of the OnX synthetic assets platform. More information on this below.

💵 Minting onE

The remint mechanism: there are 1 to 3 period windows open for the minting application. The system adjusts the minting amount dynamically and all applicants have equal chances to mint and swap proportionately.

Minting onE can be done with aETH and onS during the minting timeframes:

0.9-ETH worth of aETH and 0.1-ETH worth of onS (0.45% transaction fee for onS burning)*

0.85-ETH worth of aETH and 0.1-ETH worth of onS with a 7-day lock-up (0.45% transaction fee for onS burning)* — V2.0 iteration

0.8-ETH worth of aETH and 0.1-ETH worth of onS with a 14-day lock-up (0.45% transaction fee for onS burning)* — V2.0 iteration

onE can only be minted under two conditions:

The TWAP (time weighted average price over 24 hours) of onE should be above 1.05 ETH

There are 3 minting periods per user: 00:00 UTC, 8:00 UTC, and 16:00 UTC

*There is a max limit purchase at any given time of 5% of the circulating supply of onE, which means the limit of purchasing power expands as the supply of onE expands. Any amount sent over this limit in aETH or onS is automatically returned back to the user by the onEMinter contract

⛏ onS Swap & Mining

All the swapped assets for onS will be sent into the Vault. onS will be used for bond interest issuance, and aETH will be used for the liquidation of onB and onE.

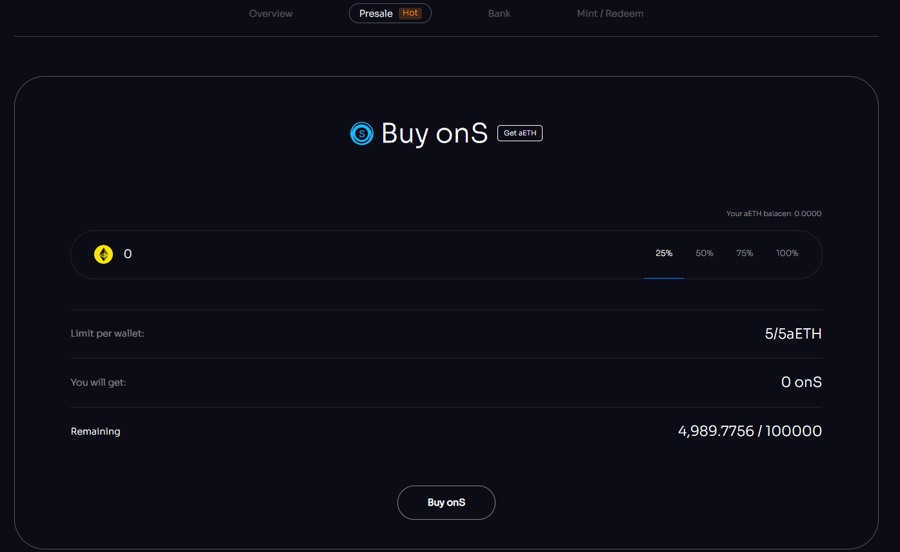

The total supply of onS will be set to 100,000 to start. However, due to the burning mechanic during the mint process of new onE — the onS token will be deflationary over time as the demand for onE increases naturally.

5,000 onS is reserved for the team to be distributed over the course of 10 months — on a monthly basis. > 80% of this is reserved for the team > 20% reserved for ONX holders. Will be distributed to ONX-ETH LP and the ONX Privilege pool.

5,000 onS is reserved for the initial swap and liquidity generation for the vault: with the price set at 0.1ETH per onS, from which the aETH value will go directly into the vault.

90,000 onS will be distributed through farming over the course of 12 months, with the distribution curve decreasing rewards by 25% per month.

The LP pools to be able to start farming for onS will be: 6X: aETH-onE LP 3X: aETH-onS LP 1X: aETH-ETH LP

Mining onE (Completed)

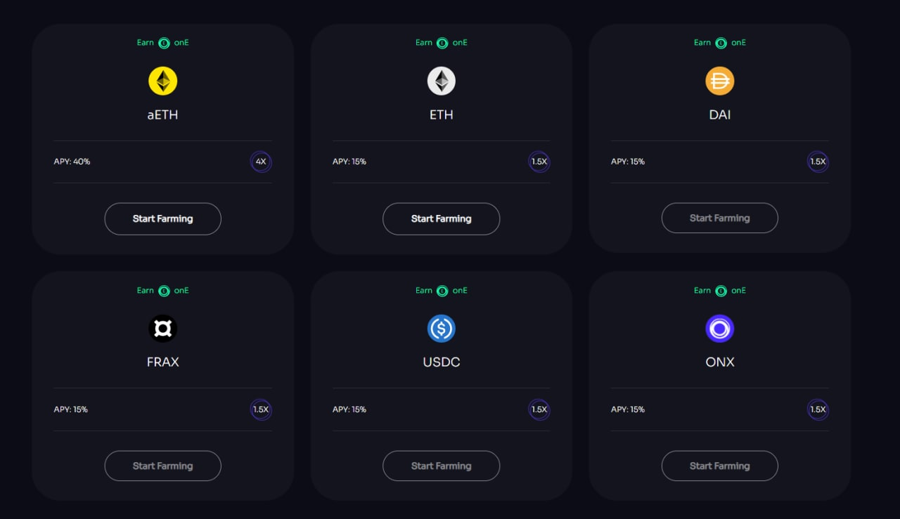

There will be a 3-day minting period which will generate 100 onE to help early adopters and assist with initial liquidity of onE. The onE will be given out to the following pools: 4X: aETH 1.5X: ETH 1.5X: DAI 1.5X: ONX 1.5X: FRAX 1.5X: USDC

🏛 onVault

Dividends (onS) One incentivization for the vault will be for onS holders — as dividends. aETH is an interest bearing staking certificate for ETH2.0. All of the extra aETH in the vault will be used to reward onS holders. The dividend time and size will be ultimately decided by the community via governance.

Bonds (onB) When the price of onE stays below 1ETH for more than three hours, onE will start to be swapped into onB. The onB holders can gain onS from the vault as interests by staking onB. 1% of the interest pool will be distributed per day and the interest will be calculated on a daily basis. When the price of onE increases above 1 ETH, onB will start to be swapped into onE and the interest will stop bearing. If onE stays below 1 ETH for 30 days, onB liquidation will be switched on with the following rules: onB holders enjoy the privilege to liquidate the vault security deposit in full first. However, if the security deposit is not enough, the system will swap for onB certificates.

Liquidation (onE) onE liquidation will be switched on after the liquidation of onB ends. Holders can inject their onE into the burning pool and automatically get the proportionate aETH in the security deposit from the Vault as liquidation compensation via the following formula: aETH = (onE injected / onE in circulation) * total aETH in the Vault

📅Schedule

- ONX platform is exploring LP vaults and other strategies that will benefit ONX holders. Please send any ideas to @nightvaultking on telegram, our strategy manager!

Last updated

Was this helpful?